NY Satisfaction of Mortgage free printable template

Show details

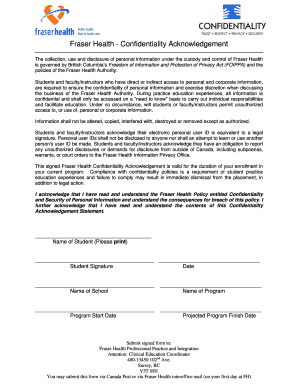

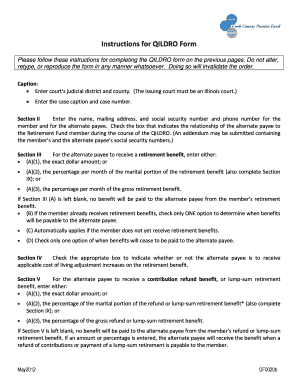

Satisfaction of Mortgage - Uniform Acknowledgment CONSULT YOUR LAWYER BEFORE SIGNING THIS INSTRUMENT-THIS INSTRUMENT SHOULD BE USED BY LAWYERS ONLY KNOW ALL MEN BY THESE PRESENTS Insert residence if individual or principal office if corporation giving street and street number. Signature and office of individual taking proof State or District of Columbia Territory or Foreign Country of before me the undersigned personally appeared same in his/her/their capacity ies and that by his/her/their...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign printable satisfaction of mortgage form

Edit your satisfaction of mortgage form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your satisfaction of mortgage form pdf form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit satisfaction of mortgage letter online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to account. Click on Start Free Trial and sign up a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit satisfaction of mortgage pdf form. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out satisfaction of mortgage template form

How to fill out NY Satisfaction of Mortgage

01

Obtain a copy of the original mortgage document and the Satisfaction of Mortgage form.

02

Fill in the borrower's name, the lender's name, and the property address on the Satisfaction of Mortgage form.

03

Include the original loan amount and the date of the mortgage in the designated fields.

04

Indicate that the mortgage has been paid in full.

05

Have the lender sign the form in front of a notary public.

06

Notarize the signatures on the Satisfaction of Mortgage form.

07

File the completed Satisfaction of Mortgage form at the appropriate county clerk's office.

Who needs NY Satisfaction of Mortgage?

01

Homeowners who have paid off their mortgage.

02

Lenders who need to officially document the satisfaction of a mortgage.

03

Title companies involved in real estate transactions.

Fill

discharge of mortgage form ny

: Try Risk Free

People Also Ask about how to fill out ny have paid off their mortgage

What is a satisfaction of mortgage form in Florida?

How Do Florida Mortgage Satisfactions Work? Written acknowledgment. Upon receiving your final payment, the lender must execute and file a written, notarized document (typically referred to as a release or satisfaction of mortgage) that acknowledges the mortgage is satisfied or paid in full.

What is a satisfaction of mortgage document in Florida?

How Do Florida Mortgage Satisfactions Work? Written acknowledgment. Upon receiving your final payment, the lender must execute and file a written, notarized document (typically referred to as a release or satisfaction of mortgage) that acknowledges the mortgage is satisfied or paid in full.

Who is the grantor in a satisfaction of mortgage?

The Grantor is the seller (on deeds), or borrower (on mortgages). The Grantor is usually the one who signed the document.

What is a satisfaction of mortgage document?

A satisfaction of mortgage is a document that proves the borrower has paid off the mortgage in full, freeing the loan's lien on the property and giving the title to the borrower.

How do you write a satisfaction of a mortgage?

In addition the following information should be included: The Payee Name. The Owner(s) of the mortgage holder. Total amount of mortgage. Mortgage date of execution. Full and legal description of the property to include tax parcel number. Acknowledgement that all payments have been made in full.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my satisfaction of mortgage fort myers fl in Gmail?

satisfaction of mortgage form fort myers fl and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

How do I complete mortgage satisfaction document on an iOS device?

Download and install the pdfFiller iOS app. Then, launch the app and log in or create an account to have access to all of the editing tools of the solution. Upload your mortgage satisfaction letter from your device or cloud storage to open it, or input the document URL. After filling out all of the essential areas in the document and eSigning it (if necessary), you may save it or share it with others.

How do I edit mortgage satisfaction form on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute mortgage satisfaction letter sample from anywhere with an internet connection. Take use of the app's mobile capabilities.

What is NY Satisfaction of Mortgage?

NY Satisfaction of Mortgage is a legal document that confirms the repayment of a mortgage loan, indicating that the lender has relinquished the borrower's obligations under the mortgage.

Who is required to file NY Satisfaction of Mortgage?

The lender or mortgagee who held the mortgage is required to file the NY Satisfaction of Mortgage once the mortgage has been paid off.

How to fill out NY Satisfaction of Mortgage?

To fill out the NY Satisfaction of Mortgage, provide the mortgagee's details, the mortgagor's details, the original mortgage information, and indicate that the mortgage has been satisfied, including the date of satisfaction.

What is the purpose of NY Satisfaction of Mortgage?

The purpose of the NY Satisfaction of Mortgage is to officially document that the mortgage has been paid in full, protecting the borrower's property rights and allowing them to clear the mortgage lien from the property title.

What information must be reported on NY Satisfaction of Mortgage?

The information that must be reported includes the names and addresses of the mortgagee and mortgagor, the date of the original mortgage, the date the mortgage was satisfied, and a legal description of the property.

Fill out your NY Satisfaction of Mortgage online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Satisfaction Of Mortgage Florida is not the form you're looking for?Search for another form here.

Keywords relevant to satisfaction of mortgage document

Related to satisfaction of mortgage forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.